Case Studies Stocks and Bonds

Posted on July 1, 2015

Tags: Economics

1 Example 1

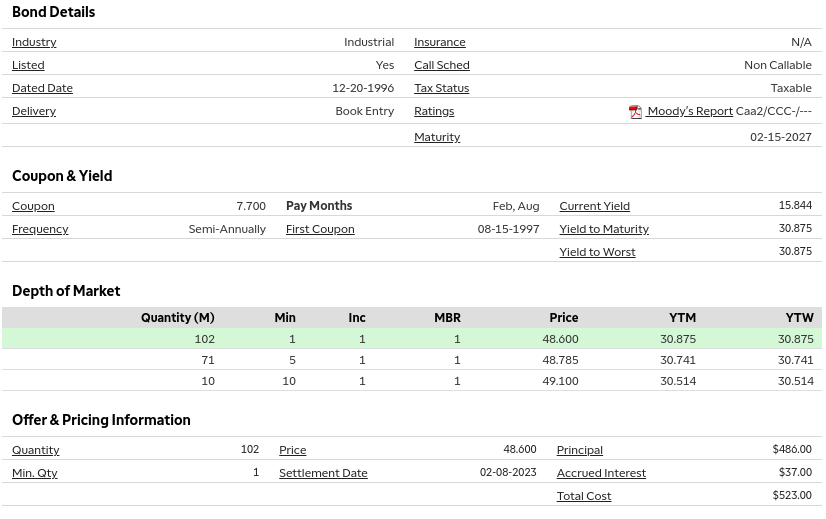

- Par value is bond price when issued

- Coupon rate is the interest rate paid to you which is fixed amount and based on Par value

- Yield rate is the amount paid to you normalized against current Market value as opposed to the Par value in coupon rate

NOTICE: when yield rate 15.844% is higher than coupon rate 7.700% it means since this bond was issued, the company financials went from bad to worse,

- people are dumping bonds => bond market price to drop => bond yield rate increases